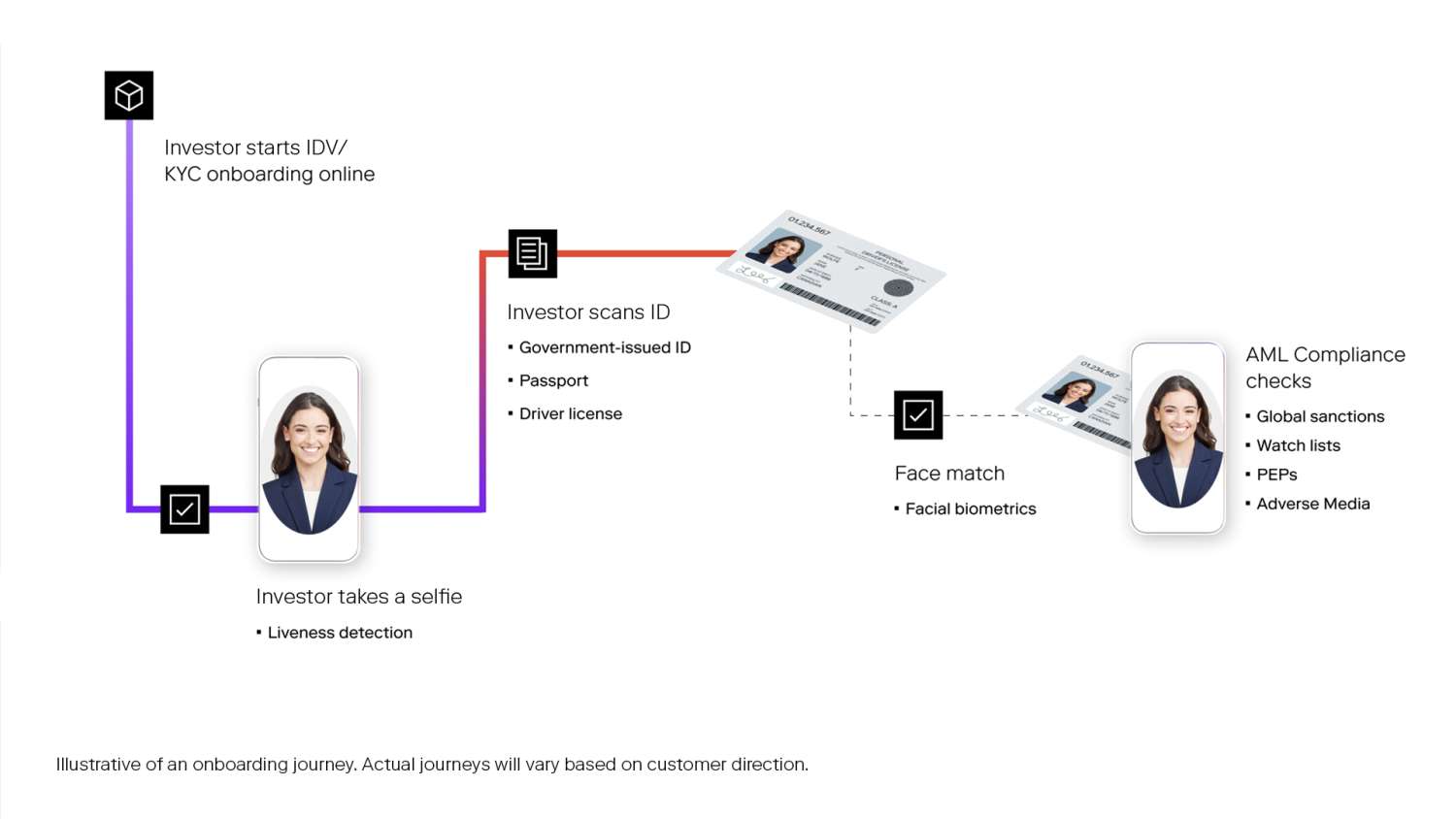

If a customer desires, our eKYC® process can be 100% automated, with investor identity verification in just 35 seconds. The system has robust security and is Anti-Money Laundering (AML) compliant, providing a safe and secure approach to identity verification at scale.

Our identity verification process requires only one government-issued ID and a selfie.

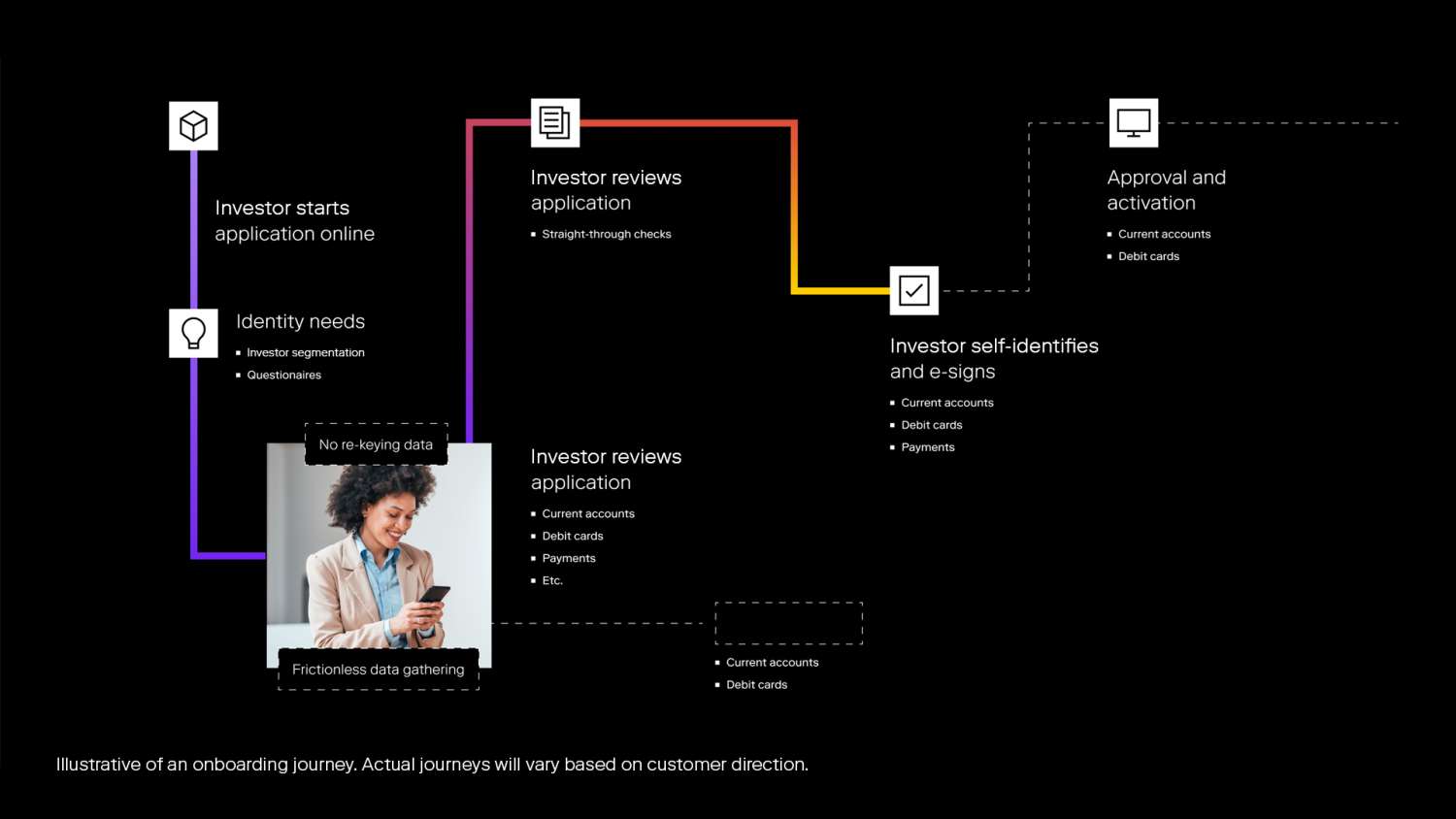

With a seamless user experience, designed to eliminate drop-offs, we help ensure end-investor satisfaction and reliability for your growth demands.

Data source: FNZ Platform analysis 2022-23